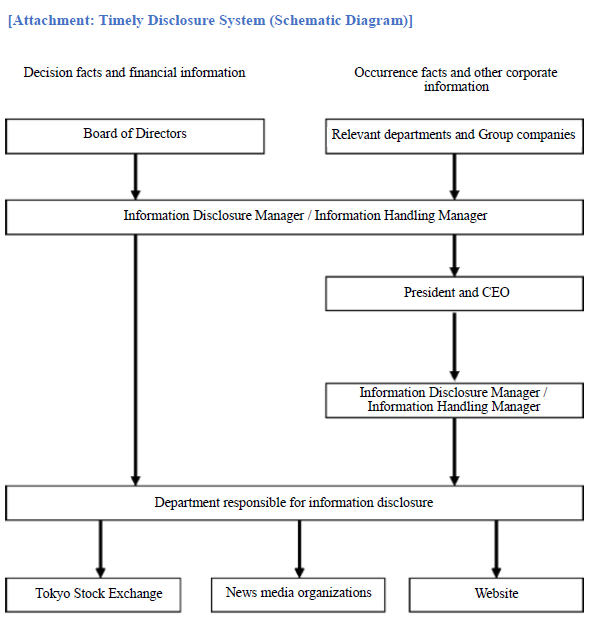

The Company believes that timely disclosure for investors and other stakeholders is an important management issue. Based on this belief, it will actively and rapidly provide disclosure of information.

Specifically, the Company’s internal structure for providing timely disclosure works as follows.

The General Manager of the Corporate Planning Dept. is the Company’s Information Disclosure Manager and Information Handling Manager. Under the direction of the Information Disclosure Manager/Information Handling Manager, the Corporate Planning Dept. discloses information as the department responsible for information disclosure.

With regard to decision facts and financial information (including quarterly disclosure), following institutional decisions on such matters by the Board of Directors or their approval thereof, the department responsible for information disclosure promptly provides disclosure under the direction of the Information Handling Manager.

With regard to occurrence facts and other corporate information, information is gathered from the relevant departments and Group companies and consolidated under the Information Disclosure Manager/Information Handling Manager. The Information Disclosure Manager/Information Handling Manager considers factors such as the materiality of the information and reports material information to the President and CEO. If the information is judged to be a matter for disclosure, the Information Disclosure Manager/Information Handling Manager will instruct the department responsible for information disclosure to disclose it.

The flow of the timely disclosure process described above is depicted graphically in the attachment titled “Timely Disclosure System (Schematic Diagram).”

Basic Information

Basic Polisy

TechMatrix Corporation (“the Company”) views increasing its corporate value as a top priority, and strives to maintain and enhance its competitiveness,as well as maximize the added value it can provide to customers. To this end, the Company believes that enhancing management transparency and improving management efficiency to enable strategic and speedy management decision-making are the foundations of corporate governance. Based on this basic policy, the Company is working to realize a highly transparent management structure through the participation of Outside Directors and to conduct management decision-making and rapid and appropriate business execution through the separation of management decision-making and the supervision of business execution from the business execution system. The Company is also striving to realize adequate supervision and auditing of management and business execution.Moreover, the Company also believes that measures to strengthen compliance are an important priority for fulfilling its responsibilities as a corporate citizen.

Reasons for Selecting Corporate Governance System

The Company views increasing its corporate value as a top priority, and strives to maintain and enhance its competitiveness, as well as maximize the added value it can provide to customers. To this end, the Company believes that the foundations of corporate governance is to build a system that balances the above with strategic and speedy management decision-making, prompt and accurate business execution based on the decision-making process, and sufficient supervisory auditing of management and business execution.Corporate Governance System

Form of Organization

Company with an Audit & Supervisory Committee| Number of Directors Stipulated in Articles of Incorporation | 13 |

| Term of Office for Directors Stipulated in Articles of Incorporation | 1 year |

| Chairman of the Board of Directors | President |

| Number of Directors | 10 |

| Appointment of Outside Directors | Appointed |

| Number of Outside Directors | 6 |

| Number of Outside Directors Designated as Independent Director | 6 |

| Outsider Directors Ratio | 60%(7 outsider directors) |

| Female Directors Ratio | 20%(2 Female directors) |

Skills Matrix

| Corporate management | Finance/ Accounting | Legal/ Risk management | Sales/ Marketing | Industry knowledge/ Technology | Internatio- nalism |

Human resources development/ Diversity | |

| Judgment criteria (3 years or more) |

Management experience or experience as a full-time director | Finance/ accounting knowledge and experience | Legal, risk management, internal control, and audit experience |

Sales or marketing experience |

Experience working in the Company's business markets or related markets |

Experience in transactions with foreign countries or experience as an officer in an overseas company |

Experience in human resources development and training or promoting diversity |

| Takaharu Yai | ○ |

○ |

○ |

○ |

|||

| Yoshihisa Yoda | ○ |

○ |

○ |

○ |

|||

| Takeshi Suzuki | ○ |

○ |

○ |

○ |

|||

| Kenya Shiga | ○ |

○ |

○ |

||||

| Hiroaki Yasutake | ○ |

○ |

○ |

○ |

○ |

||

| Ari Horie | ○ |

○ |

○ |

○ |

○ |

||

| Masato Kubo | 〇 |

〇 |

〇 |

||||

| Hideyuki Sasaki | ○ |

○ |

○ |

○ |

○ |

||

| Naho Ebata | ○ |

○ |

|||||

| Koji Taira | ○ |

〇 |

〇 |

Audit & Supervisory Committee

| All Members(people) | Full time members(people) | Internal Members(people) | Outsiders Directors(people) | Commitee Chair(Chair) | |

| Audit & Supervisory Committee | 4 |

1 |

0 |

4 |

Outside Director |

| Existence of Directors and Employees Responsible for Assisting the Duties of the Audit & Supervisory Committee | Yes |

Voluntary Committee Equivalent to a Nomination and a Remuneration Committee

| Name of Committee | All Members (people) |

Full-time Members (people) |

Internal Directors (people) |

Outside Directors (people) |

Outside Experts (people) |

Committee Chair (Chair) |

| Personnel Committee | 4 |

1 |

1 |

3 |

0 |

Outsider Director |

Outside Directors

Name |

Audit & Supervisory Committee Member |

Independent Officer |

Supplementary Information Related to the Criteria |

Reasons for Appointment |

| Hiroaki Yasutake | ○ |

Mr. Hiroaki Yasutake served as Director of Rakuten, Inc. (currently Rakuten Group, Inc.) until January 10, 2016. The Company’s revenue from Rakuten Group, Inc. accounts for a relatively small share of the Company’s revenue (less than 1% of the Company’s consolidated revenue), and the transaction terms with Rakuten Group, Inc. are similar to those with other companies. Furthermore, the holding purpose of the Company’s shares of Rakuten Group, Inc. have been reclassified from held for purposes other than pure investment to held for pure investment by a resolution of the Board of Directors at a meeting held on June 24, 2022. Accordingly, there is nothing significant that could affect independence. |

The Company has judged that Mr. Yasutake’s knowledge and experience in the Internet business and system development field can be put to good use in the Company’s management. Therefore, the Company put forward a proposal on Mr. Yasutake’s appointment to the Ordinary General Meeting of Shareholders in June 2025, and it was approved. In addition, Mr. Yasutake meets the independence requirements for Independent Officers set forth by the Tokyo Stock Exchange. Accordingly, the Company has appointed him as an Independent Officer based on its belief that he does not pose a risk of creating conflicts of interest with ordinary shareholders. |

|

| Ari Horie | ○ |

Ms. Ari Horie is the Founder and Chief Executive Officer (CEO) of Women’s Startup Lab, Inc. The Company has transactions with Women’s Startup Lab, Inc. concerning an employee training seminar held in June 2021. However, payments from the Company to Women’s Startup Lab, Inc. were negligible (less than ¥1 million), the transaction amount accounts for a relatively small share of the Company’s revenue, and the transaction conditions are similar to those with other companies. Accordingly, there is nothing significant that could affect independence. |

Ms. Ari Horie offers a training program for women entrepreneurs in Silicon Valley, U.S. and has a wealth of experience and outstanding knowledge in fostering next-generation leaders based on entrepreneurship. The Company expects her to provide effective advice on the Company’s management from the perspective of women’s advancement in the workplace and from a standpoint independent of the management team. Therefore, the Company put forward a proposal on Ms. Horie’s appointment to the Ordinary General Meeting of Shareholders in June 2025, and it was approved. In addition, Ms. Horie meets the independence requirements for Independent Officers set forth by the Tokyo Stock Exchange. Accordingly, the Company has appointed her as an Independent Officer based on its belief that she does not pose a risk of creating conflicts of interest with ordinary shareholders. |

|

| Masato Kubo | ○ |

Mr. Masato Kubo was an employee of Rakuten, Inc. (currently Rakuten Group, Inc.) until October 2011. Sales to Rakuten, Inc. are relatively small as a percentage of our company's sales (less than 1% of our company's consolidated sales), and the company's transaction terms are the same as those of other companies. | The Company judged that he has a wealth of experience and insight in marketing and can be expected to provide effective advice and opinions to the Company's management, mainly from the perspective of data marketing, which the Company has not been able to focus on to date, and proposed his appointment to the Ordinary General Meeting of Shareholders in June 2025, which was approved. In addition, the Company recognizes that there is no risk of a conflict of interest with general shareholders, as he satisfies the requirements for independence of independent directors as stipulated by the Tokyo Stock Exchange. |

|

| Hideyuki Sasaki | ○ |

○ |

Mr. Hideyuki Sasaki was an employee (Associate Director of the Internal Audit Department) of Mizuho Corporate Bank, Ltd. (currently Mizuho Bank, Ltd.) until June 29, 2007. The Company’s transactions with Mizuho Bank, Ltd. are negligible in value (less than 1% of the Company’s consolidated revenue). Accordingly, the Company has judged that Mizuho Bank, Ltd. is not a major client of the Company. Following the abovementioned role, Mr. Sasaki served as Senior Audit & Supervisory Board Member of SANYO SPECIAL STEEL, CO., LTD. and Dai-ichi Leasing Co., Ltd. The Company has no transactions with the former company, SANYO SPECIAL STEEL, CO., Ltd. The Company’s revenue from the latter company, Dai-ichi Leasing Co., Ltd., accounts for a relatively small share of its revenue (less than 1% of the Company’s consolidated revenue) and the transaction conditions with the latter company are similar to those with other companies. Accordingly, there is nothing significant that could affect independence. Accordingly, there is nothing significant that could affect independence. |

Mr. Hideyuki Sasaki has knowledge and experience in corporate management, internal control and international operations as well as considerable insight into finance and accounting. The Company has judged that Mr. Sasaki’s knowledge and experience in those fields can be put to good use in the Company’s management. Therefore, the Company put forward a proposal on Mr. Sasaki’s appointment to the Ordinary General Meeting of Shareholders in June 2025, and it was approved. In addition, Mr. Sasaki meets the independence requirements for Independent Officers set forth by the Tokyo Stock Exchange. Accordingly, the Company has appointed him as an Independent Officer based on its belief that he does not pose a risk of creating conflicts of interest with ordinary shareholders. |

| Naho Ebata | ○ |

○ |

- |

The Board of Directors of the Company, in the belief that she would provide effective advice from her professional perspective as an attorney at law, particularly in the area of corporate legal affairs, and that she would provide effective advice from an independent position with no relationship with the Company, for the purpose of strengthening the monitoring function and corporate governance, proposed his appointment to the Ordinary General Meeting of Shareholders in June 2025, which was approved. The appointment was approved at the Ordinary General Meeting of Shareholders held in June 2025. In addition, as she satisfies the requirements for independence as stipulated by the Tokyo Stock Exchange, the Company recognizes that there is no risk of a conflict of interest between her and general shareholders, and has appointed her as an independent director. |

| Koji Taira | ○ |

○ |

Mr. Koji Taira is an employee of Toshiba Tec Corporation and a business executor of TD Payment Corporation. However, sales to the former account for a relatively small percentage of our sales (less than 1% of our consolidated sales), the company's terms of business are the same as those of other companies, and there are no transactions with the latter with our company, There are no transactions with the latter, and there is no materiality that would affect the independence of the Company. |

The Board of Directors of the Company has determined that he not only has advanced knowledge and experience in service planning, marketing, and sales, but also has experience in formulating management strategies and growth strategies, and that he can be expected to provide effective input into the management of the Company. The Board of Directors submitted a proposal for his appointment to the Annual General Meeting of Shareholders in June 2025, and the proposal was approved. In addition, as he satisfies the requirements for independence as stipulated by the Tokyo Stock Exchange, the Company recognizes that he is a person with whom there is no risk of a conflict of interest with general shareholders, and has therefore appointed him as an independent director. |

Directors’ Remuneration

(1) Overview of Remuneration System for Officers (Directors and Audit & Supervisory Committee Members)

The Company’s basic policy is to adopt a remuneration structure linked to shareholder interests so that the remuneration of each Director provides adequate incentive for them to achieve sustained increases in corporate value. The basic policy also calls for setting the remuneration of each individual Director at an appropriate level based on each Director’s individual job responsibilities when determining such remuneration. Specifically, the remuneration of Executive Directors comprises base remuneration as fixed remuneration, as well as performance-linked monetary remuneration, post-delivery type performance-linked share remuneration and stock option remuneration as performance-linked remuneration. Outside Directors, who assume a supervisory role, are paid only base remuneration in light of their duties.

・Base remuneration

Base remuneration is provided as monthly fixed remuneration. It is determined by taking into account a comprehensive range of factors in accordance with position, job responsibilities, and years of service, while considering other companies’ remuneration levels, the Company’s business results, the level of employee wages, and remuneration from subsidiaries and other entities where important positions are concurrently held.

・Performance-linked remuneration

The policy for determining the details of performance-linked remuneration for the Company’s Executive Directors, as well as the methodologies for calculating the amounts or quantities of such remuneration, are outlined below.

With performance-linked monetary remuneration, the Company defines the responsibility of eligible Directors for performance targets by paying monetary remuneration based on the achievement of those targets, in order to promote the sharing of even more value with shareholders. Specifically, under this remuneration plan, the Company’s Board of Directors establishes numerical targets in advance for a certain period it defines, and remuneration varies with the achievement rate against those numerical targets, among other criteria. The amount of this monetary remuneration is

calculated by multiplying (1) a base remuneration amount determined by the Board of Directors for each Executive Director position by (2) an achievement rate against a numerical performance target determined by the Board of Directors and (3) a period-of-service ratio. The Board of Directors will determine the specifics of the remuneration, including details and the time period during which remuneration is provided.

With post-delivery type performance-linked share remuneration, the Company grants stock remuneration as an incentive for eligible Directors to improve the Company’s corporate value by defining their responsibility for performance targets and paying monetary remuneration based on the achievement of those targets. The purpose of this remuneration is for the eligible Directors to share the benefits and the risks of movements in the Company’s stock price with shareholders. Specifically, under this remuneration plan, the Company’s Board of Directors establishes numerical targets in advance for a certain period it defines, and remuneration varies with the achievement rate against those numerical targets, among other criteria. The number of shares to be granted is calculated by multiplying (1) a base number of shares to be granted as determined by the Board of Directors for each Executive Director position by (2) an achievement rate against a numerical performance target determined by the Board of Directors, and (3) a period-of-service ratio. The Board of Directors will determine the specifics of the remuneration, including details and the time period during which remuneration is provided.

・Stock Compensation

The Company has introduced stock option remuneration to create a remuneration structure that is aligned with shareholder interests to ensure that the structure functions adequately as incentive for efforts to achieve sustained improvement in corporate value and shares the benefits and the risks of movements in the Company’s stock price with shareholders. Regarding the calculation method, the Company employs the fair value computed using the Black-Scholes model to determine the number of shares to be allotted for the standard amount of each Director’s non-monetary remuneration. The Board of Directors will determine the specifics of the remuneration, including details and the time period during which remuneration is provided. However, these specifics are determined based on reports from the Personnel Committee.

(2) Allocation Ratio by Type and Determination Procedure for Officers’ Remuneration and Related Items

The allocation ratio of Executive Directors’ remuneration by type is determined based on remuneration standards that reflect as benchmarks the remuneration standards of companies with a comparable business size to the Company as well as companies affiliated with relevant industries and business formats. The amount of performance-linked remuneration and stock options (remuneration for which the value of remuneration received is linked to performance, stock price and other factors) is estimated to be between 30% and 40% of total remuneration. However, this principle shall not apply in circumstances where, for example, the Company’s base remuneration is not paid because an Officer receives remuneration for holding an important concurrent position at a subsidiary or other such entity. The total amount of remuneration is determined based on reports received from the Personnel Committee (made up of a majority of Outside Directors who are Independent Officers), which is a voluntary nomination and remuneration committee, with such remuneration set to correspond to each Director’s responsibilities.

In addition, the President and CEO is entrusted with the specific details of individual remuneration for Directors based on a resolution by the Board of Directors. The scope of authority of the President and CEO covers the amount of base remuneration of each Director and the number of stock options allotted to each individual Director. The performance-linked remuneration of each individual Director is paid in accordance with a standard amount and target achievement rate established in advance by the Board of Directors. To ensure that this authority is properly exercised by the President and CEO, the Board of Directors submits the original proposal for review to the Personnel Committee, and the committee reports back to the Board of Directors. The President and CEO, who is entrusted with this authority as described above, is required to make the determination in accordance with the content of the report.

(3) Resolutions of the General Meeting of Shareholders on Officers’ Remuneration and Related Items

The amount of monetary remuneration of the Company’s Directors excluding Directors who are Audit & Supervisory Committee Members was approved by the Ordinary General Meeting of Shareholders held on June 24, 2022 as a limit on the remuneration of Directors of no more than ¥160 million per year (including remuneration of Outside Directors of ¥35 million per year) (hereinafter, the “base remuneration limit”). When the resolution was passed, there were seven Directors (including three Outside Directors).

In addition, the Company has obtained approval to set the remuneration limit for granting performance-linked monetary remuneration to Directors excluding Directors who are Audit & Supervisory Committee Members and Outside Directors at no more than ¥60 million per year, with this limit being separate from the base remuneration limit and the stock option remuneration described below. As a remuneration limit for granting post-delivery type performance-linked share remuneration, the Company has obtained approval to set the number of shares to be granted at no more than 60,000 shares per year and the amount of monetary remuneration receivable to be paid at no more than ¥60 million per year. When each resolution was passed, there were four eligible Directors.

Furthermore, the share acquisition rights that can be allotted as stock option remuneration to Directors excluding Directors who are Audit & Supervisory Committee Members and Outside Directors was approved by the Ordinary General Meeting of Shareholders held on June 24, 2016 at no more than ¥20 million per year (the number to be granted shall be no more than 200 per year, and the underlying shares shall be no more than 20,000 shares per year of the Company’s common stock), separately from the base remuneration limit. When the resolution was passed, there were four eligible Directors.

The remuneration of Directors who are Audit & Supervisory Committee Members of the Company was approved by the Ordinary General Meeting of Shareholders held on June 24, 2022 as no more than ¥50 million per year. When the resolution was passed, there were four Audit & Supervisory Committee Members.

The Corporate Planning Dept. serves as the point of contact and communicates information to the Outside Directors about the Board of Directors. It sends documents covering significant agenda issues for Board of Directors meetings to the Outside Directors prior to meetings. The Corporate Planning Dept. also provides briefings and reports before and after meetings as necessary.